All Sections of Goods and Service Tax List of GST All Sections. A Nil GST Return must be filed within the specified time frame even if there is no GST return amount to be paid to the tax authority.

How To Manually Adjust The Gst Amount When Creating A New Spend Money Or Bill

GSTR 20131 Goods and services tax.

. Tax base determination in Singapore. List of all sections of GST Act 2017. Penalty for not registering under GST.

10000 whichever is higher. Claim 100 tax credits everytime. ClearTax GST Software simplifies GST Return Filing GST Invoices and provides Free Hands on GST Training to Tax Experts Businesses.

Penalty 100 of the tax due or Rs. Sales Tax Rates Of Tax Order 2022. 100 accurate designed by 60 inhouse tax experts.

In total a late cost of INR 100. According to the Singapore tax code taxation in the city-state is made based on the resident status of payersThis principle applies to both natural persons and companies and implies several aspects. 10000 -whichever is higher if the additional GST collected is not submitted with the govt Penalty for not issuing an invoice.

This will assist the. Taxable and non-taxable sales. Latest News on GST 2022.

If you supply or receive an invoice that only has a figure at a wine equalisation tax-goods services tax WEG label you need further information to claim GST credits and for it to be considered a valid tax invoice. GST Section 2022. 10000 whichever is higher.

CGST Section 2022 updated. Extension Of Payment Date For Phase 1 Of Special Programme On Indirect Tax Voluntary Disclosure And Amnesty VA More 08062022. CBIC extends waiver of late fee for delay in filing FORM GSTR-4.

Goods and Services Tax - There is full code of law for Reverse Charge under GST. CGST Act with all Sections Download GST Complete Section List in PDF Format. 2-7 tax savings with smart reconciliation and reports.

Before GST Launch Maharashtra Passes Bill to Waive Arrears. Tax invoices sets out the information requirements for a tax invoice in more detail. Penalty 100 of the tax due or Rs.

Latest GST Ready Reckoner 2022 by CA Raman Singla. Punjab government lines up workshops on food safety standards from July 5. If you miss the deadline for filing your NIL returns you will be charged a late fee on a per-day basis.

Sales Tax Goods Exempted From Tax Order 2022. Penalty 100 of the tax due or Rs. Check out our HSN Code finder HSN stands for Harmonized System of Nomenclature which is an internationally accepted product coding system used to maintain uniformity in the classification of goods.

Alice can claim a GST credit of 2 on her activity statement and 20 as an income tax deduction on her tax return. CBIC extends due date of furnishing FORM GST CMP-08 for June 2022. There is definition clause for reverse charge goods or services are specified on which reverse charge be applicable supplier and recipient notified for the purpose of reverse charge time of supply provisions available for reverse charge input tax definition is also there for reve.

Deferment Of Service Tax On The Goods Delivery Service Implementation. HSN Code List for GST in pdf HSC Codes in Excel Format Find HSN Code for Your Business. Updated Section wise analysis of gst act 2017 As amended 01 June 2021.

End of example If youre not entitled to a GST credit claim the full cost of the business purchase including any GST as a deduction. AND SAC stands for Service Accounting Codes which are adopted by. Check GST ALL Sections GST E-Book in PDF.

INR 50 is charged each day under the CGST Act while INR 50 is charged per day under the SGST Act. CBIC extends compliance dates related to tax recovery. Join our newsletter to stay updated on Taxation and.

G1 to G9C all returns made at least 3x faster. The state government will organise workshops on Food Safety and Standards Act 2006 from July 5. In the case of individuals taxation is determined on whether a person is a Singapore tax resident or notIn order to be deemed as.

View All Featured Posts. Signup for a Free Trial. The Maharashtra legislature enacted a bill on Monday March 21 2022 to provide for the payment of tax interest penalty and late fee arrears that were due under Acts previous to the implementation of the Goods and Services Tax GST.

Gst Portal Provides Simple To Use Offline Utility For Uploading Invoice Data And Other Records For Creating Gstr 1 Accounting And Finance Worksheets Offline

Deemed Supplies Scenarios Malaysia Gst Sap Blogs

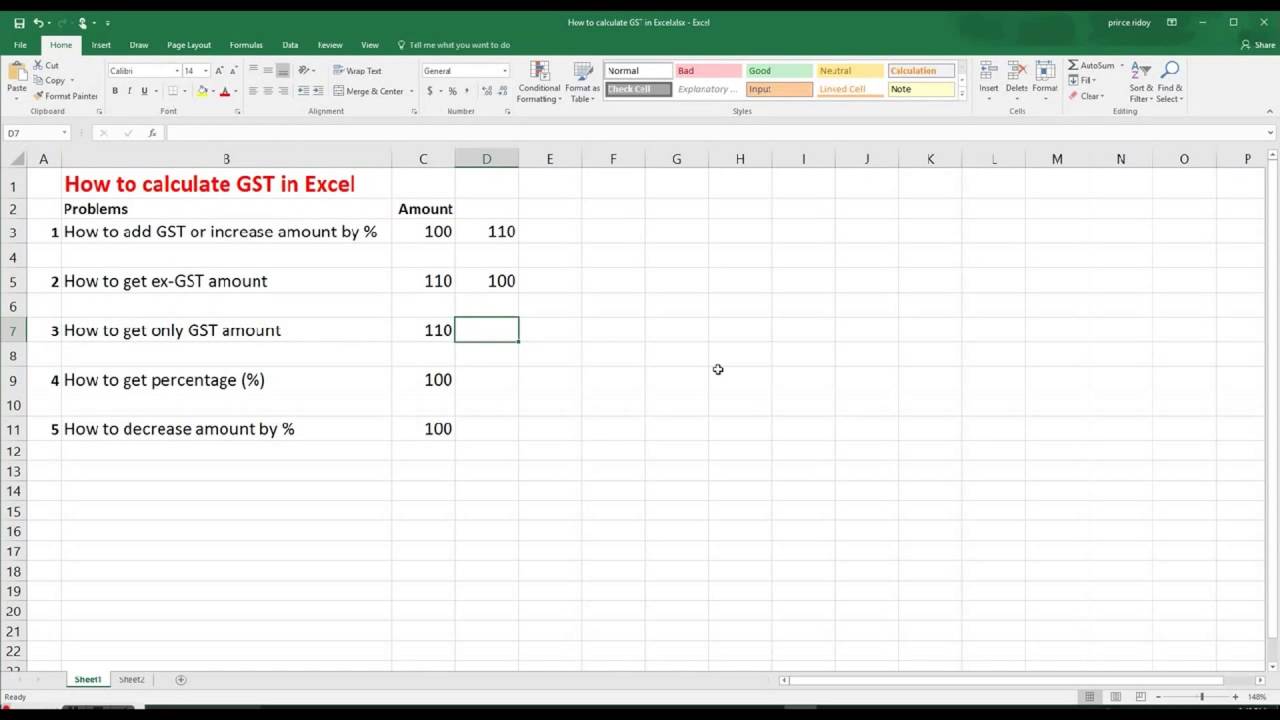

How To Calculate Gst In Excel By Using Different Techniques With Easy Step By Step Tutorial Youtube

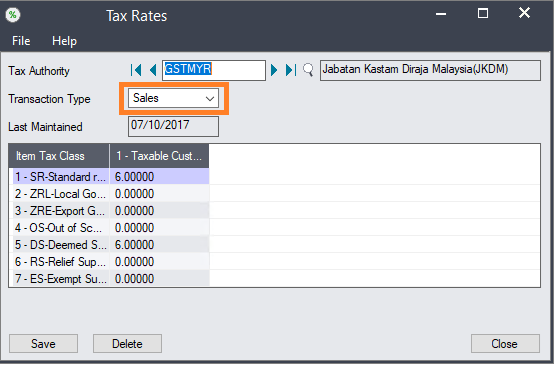

Setting Gst To 0 In Sage 300 Sage 300 Malaysia

Complete Sst System Setup Guideline Help

Deemed Supplies Scenarios Malaysia Gst Sap Blogs

Excel Tutorial Formulas For Calculating Gst At 15 Youtube

Deemed Supplies Scenarios Malaysia Gst Sap Blogs

Import Goods That Have Gst Finance Dynamics 365 Microsoft Docs

Implementation Of Goods And Service Tax Gst In Malaysia Yyc Goods And Services Goods And Service Tax Malaysia

![]()

Gst Goods And Services Tax Symbol Businessman Holds A Cube With Up And Down Icon Word Gst Beautiful White Background Copy Space Business And G Stock Photo Alamy

Setting Gst To 0 In Sage 300 Sage 300 Malaysia

The Brief History Of Gst Goods And Service Tax Goods And Services Goods And Service Tax Get Gift Cards

Gst Rates In 2022 List Of Goods Services Tax Rates Slabs And Revision